- Life@SPJIMR

- Placements

- Alumni

- Newsroom

- Careers@SPJIMR

- Contact Us

- Explore Programmes

- Post Graduate

- Full-Time

- Part-Time

- Post Graduate Executive Management Programme (PGEMP)

- Post Graduate Programme in Development Management (PGPDM)

- Post Graduate Programme in General Management (PGPGM)

- Post Graduate Programme in Marketing & Business Management (PGP-MBM)

- Post Graduate Executive Programme in FinTech, AI/ML, Data Science & Blockchain (PGEPF)

- Modular

- Online

- Post Graduate Diploma in Management – Online (PGDM Online)

- Doctoral

- Fellow Programme in Management (FPM)

- Executive Education

- Open Management Development Programmes

- Custom Management Development Programmes

- Post Graduate Executive Management Programme (PGEMP)

- Post Graduate Programme in General Management (PGPGM)

- Post Graduate Programme in Marketing & Business Management (PGP-MBM)

- Entrepreneurship

- Start Your Business (SYB)

- Graduate Certificate Programme in Entrepreneurship (GCPE)

- FinNovate Accelerator

- Post Graduate

Find the programme that meets your requirements and aspirations.

Apply NowSPJIMR: a different kind of business school

For over 40 years, SPJIMR has blazed a distinct trail in management education in India, combining a unique mix of social sensitivity, student centricity, teaching excellence, industry connectivity, practice-oriented thought leadership, and community engagement. Through its programmes, research, and centres of practice, SPJIMR aims to foster wise innovation that creates value-based growth to benefit society. Partner with SPJIMR to shape a better world.

Know more

#AdvancingWiseInnovation

SPJIMR aims to advance wise innovation at scale by shaping the innovation practices of our stakeholders, including thousands of participants in our full-time and modular programmes; the hundreds of corporate and NGO partners who rely on us for talent acquisition and ongoing development programmes; and a select number of high leverage entrepreneurial communities or ecosystems that we support through our Centres of Practice.

Know moreWhy SPJIMR?

SPJIMR is especially known for its quality of its graduates and the impact they create. Explore how the SPJIMR experience creates exceptional leaders.

In-focus

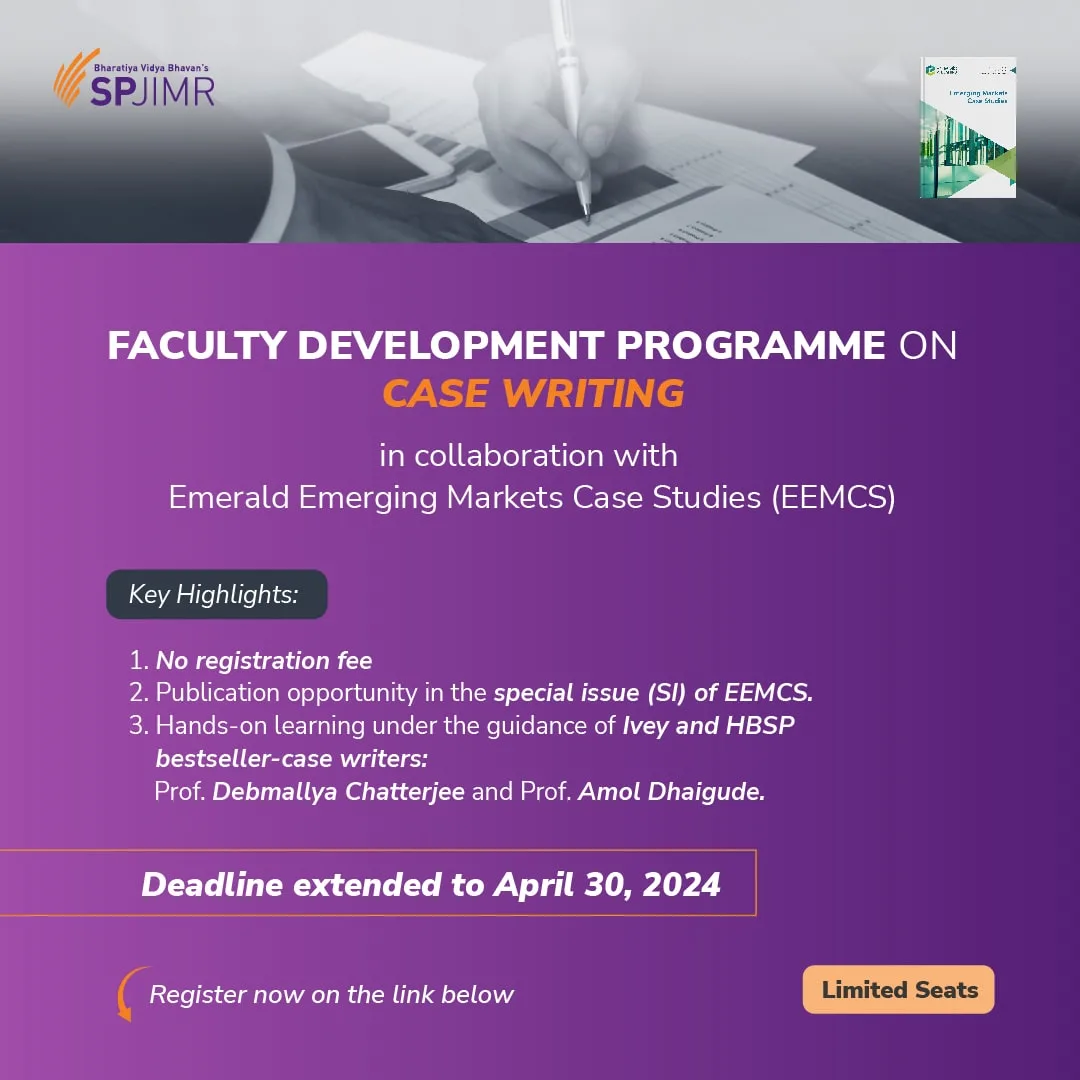

FDP Deadline Extended:

In-focus

PGPM Webinar

In-focus

PGPDM Admissions Open

In-focus

Aspire to Restart a full-time career?

In-focus

PGPM Applications Open

In-focus

SIA 2024 registration deadline extended

In-focus

GCPE Admissions Open

In-focus

PGDM Online admissions now open

Experience a global outlook

in the heart of India’s financial centre, Mumbai

Located in a thriving cosmopolitan hub that is a melting pot of knowledge, people and business, discover a confluence of global fluency and traditional ethos in how we learn, live, and grow.

Explore our programmes

SPJIMR programmes aim to develop value-based leaders who can innovate and transform companies, social sector organisations, and society. Explore and find the programme that fits your goals.

Recognition

SPJIMR is recognised by Financial Times Masters in Management (FT MIM) Rankings as one of India’s top two business schools, by Business Today as one of the country’s top five business schools, and by the Positive Impact Rating (PIR), a Swiss Association, as one of the only four pioneering business school worldwide with the highest rating for its societal impact and sustainability achievements.

Read More#

In India FT Global - Masters in Management 2023 Global Rankings#

In the World FT Global - Masters in Management 2023 Global Rankings#

In India All India Private B-schools, Business Today's BT-MRDA B-School Ranking 2023#

In India All India Private B-Schools, MBAUniverse.com 2023Top stories

View allFollow #SPJIMR

Connect with us on social media to know more about the vibrant and diverse SPJIMR community.